AUSTRALIA TO GET 52GW OF SOLAR CAPACITY IN DRAMATIC ENERGY TRANSFORMATION

By Mitchell King on 6 July 2016

The Australian infrastructure market is participating in a global energy transformation that will have a profound effect on our economy and financial markets.

We are fast approaching a tipping point in the transformation of energy markets from fossil fuels to renewables. This transformation will not be orderly, rather will be a disruptive transition that will produce significant winners and losers.

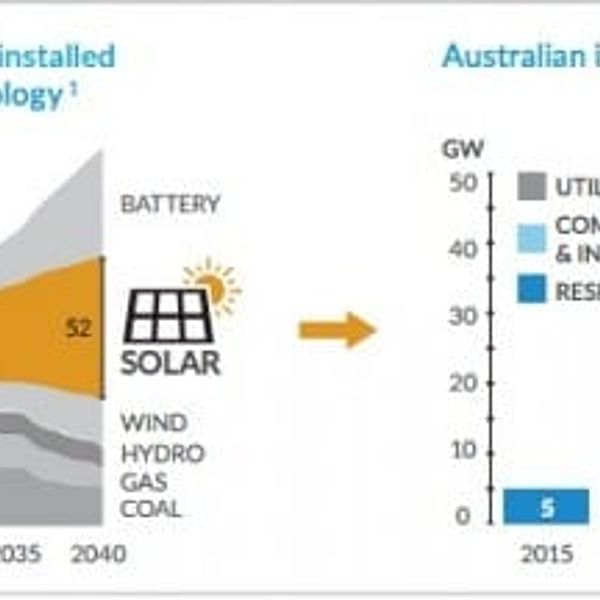

The solar industry will experience unprecedented growth, from 4GW currently to 52GW of capacity in the National Electricity Market by 2040. This will require an investment of approximately $40bn or $3bn per annum over this period in solar alone.

Global financial markets are not fully pricing the impact of climate change. The impacts of climate change will have far-reaching consequences for carbon intensive industries and global financial markets.

The Electricity sector is responsible for more than a third of Australia’s greenhouse gas emissions. Fossil fuel energy producers and carbon intensive industries have been providing some disclosure to financial markets about emissions, which to date has been mostly voluntary. Regulators have been slow to ensure this data is presented on a consistent, comparable and understandable basis. Financial markets are not fully informed and are therefore not fully pricing climate change risks into equity and bond markets.

Many institutional investors are now actively divesting fossil fuel exposures in favour of non fossil fuel exposures and investment in renewable energy. These investors have long accepted the moral argument for divestment, however are now persuaded by the economic argument that investment in a non fossil fuel portfolio is likely to produce outperformance over the long term.

This is a very deliberate strategy, which is taking time and careful consideration to execute. President of the US$860 million Rockefeller Brothers Fund, Stephen Heintz recently presented the keynote address at the Divest Invest conference in Sydney. Heintz acknowledges that the carbon-fuelled capitalism of the 20th century has brought immense prosperity to the developed world, but at a huge cost. The Fund supports the scientific contention that in order to achieve the 1.5 degree Celsius target reduction agreed in Paris in 2015, that 60–80% of known fossil fuel reserves must remain in the ground.

This means that companies owning those reserves lose material value, which provides investors the economic justification to support the moral case to divest these exposures. The Rockefeller Brothers Fund, since 2014, has been divesting its 7 percent exposure to fossil fuels and by 2017 through its divest campaign, is expecting to deliver a zero exposure to fossil fuels.

The Infrastructure Market In order to examine the impact of the energy market transformation, consider the structure of the Infrastructure industry. The infrastructure industry comprises economic and social infrastructure. Economic infrastructure has two components, energy and transport infrastructure.

To date, energy and transport infrastructure have operated somewhat independently, however, these sectors are now converging.

Disruption is occurring in global energy markets in part due to the rise in distributed solar power. This is driven by the dramatic reduction in solar system costs from scale economies achieved and associated developments in information and battery storage technology. Accelerating this disruption further is the transformation occurring in transport infrastructure, such as the commercialisation of electric vehicles.

History of Energy Infrastructure

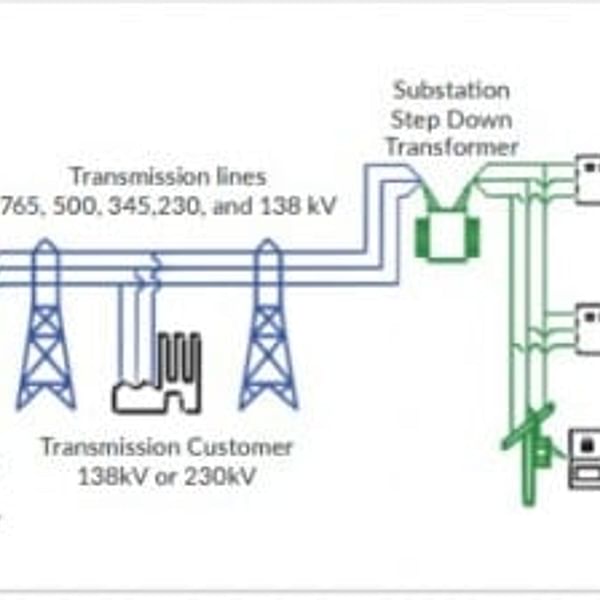

The electricity grid was developed in the United States from the late 1880s by George Westinghouse as a centralised “in series” system comprising generation, transmission and distribution. Pricing signals to market participants were generally inefficient, occurring after each 30 minute interval requiring 24 hour advanced scheduling.

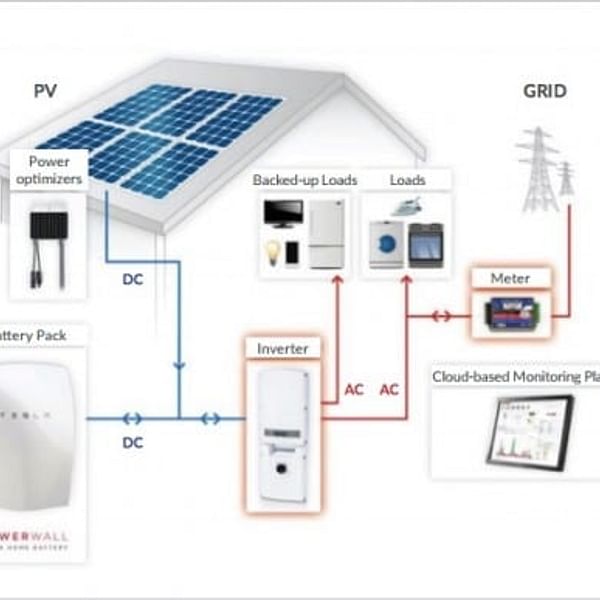

Modern Energy Infrastructure The rollout of distributed power such as rooftop solar is an important component in the development of sophisticated network architecture. Modern networks using web based monitoring devices send pricing signals at 5 second intervals. Users are demanding energy independence and want to take control of their consumption and cost.

Users are demanding this be delivered on their iPhone app and be paid for load shedding in times of high system demand or participate in the sale of excess power generated by their solar systems. Technology now exists to “swipe” your energy bill which produces automated savings by use of tariff and usage algorithms.

Information Technology companies are also vitally interested in the pattern of energy consumption. These companies are investing heavily in innovating and developing IT solutions which will accelerate energy market disruption. Monitoring devices for example provide a real time signature of the profile of energy consumption including electric appliances used including from printers, refrigerators, pool pumps, hot water services and solar panel output.

IT companies will increasingly have an intimate understanding of energy consumption patterns by collecting data from such monitoring devices and have developed applications to manage and reduce energy consumption and in time aggregate data to create electricity micro networks to pay consumers more for their solar production.

The other disruption occurring in global energy markets is the increased focus on energy efficiency and related products, most notably the massive “change out” of incandescent lighting to Light Emitting Diodes (LEDs). The implementation of these efficiency measures will accelerate the mothballing of fossil fuel power stations, reduce load and associated network requirements.

Transmission and distribution companies will be required to manage their businesses in this new paradigm of reduced load and increased efficiencies. No longer will these companies be rewarded by building networks based on an assumption of increased energy demand.

Emergence of Australian Solar Market Australia is blessed with a significant natural solar resource, having the highest level of solar irradiation in the world. Further, Australia has an abundance of suitable solar sites to exploit this resource.

Over the last six years installed solar costs have reduced by approximately 80 percent, whereas over the same period, retail tariffs have increased by approximately 75 percent.

The global migration of energy markets from fossil fuels to renewables is occurring rapidly such as in the United States during 2015, where solar and wind developments represented approximately 65% of new installed energy production.

Evolution of Solar financing product into the mainstream to create demand

Solar companies in Australia are now following overseas market precedents and are installing fully maintained solar systems for zero upfront payment, using financed solutions such as Power Purchase Agreements (PPAs) and leases.

The Australian solar market to date has been dominated by approximately 1.3 million residential users who have cash funded and installed around 3.8GW of rooftop solar systems. The Australian solar market is expected to follow overseas trends to a funded market such as in the United States where over 60 percent of solar systems are sold utilising power purchase or lease agreements, compared to just 5 percent in Australia.

The commercial & industrial and utility segments of the Australian solar market are much less penetrated despite providing a better load match of solar production to consumption.

The emergence of third party financed solar systems will further accelerate the roll out of solar systems across the country.

Electric Vehicles and emergence of battery technology

Now let’s overlay the transformation occurring in transportation infrastructure to energy infrastructure markets. Imagine over the next two decades the majority of vehicles made will be electric and use solar power combined with battery storage at home, office and in neighbourhood mini-grids.

Energy markets in the medium term will be further transformed by innovation in battery technology arising from scale economies gained from production of these “mobile batteries on wheels” (electric vehicles) and utility scale battery systems, such as that being trailed in South Australia.

Decommissioning of coal fired power stations

Demand in the National Electricity Market in Australia peaked around 2008. The peak occurred due to the effect of reduced demand brought about by the Global Financial Crisis and associated business closures. Over 4,000 megawatts of distributed solar power has been built in Australia up to 2015 (think of 2 Loy Yang A power stations).

It is highly unlikely that any new coal fired generation capacity will ever be built in the Australian National Electricity Market. Old coal fired power station “dinosaurs” such as in Port Augusta, South Australia have now been decommissioned, removing approximately 5 million tonnes per annum of Co2e, making the State free of coal fired generation. South Australia is a world leader in renewable energy with a target penetration of 50 percent by 2025.

Winners and Losers

The effect of the proliferation of solar, electric vehicles, battery storage and technology will have a profound effect on the Australian electricity market and in turn the economy.

Coal fired generators will be gradually retired, gas-fired peaking stations replaced by solar and wind. Hourly despatch periods of zero grid level demand will occur within a decade.

Globally, coal companies are already the big losers and have been part of an early structural shift by investors, banks and stakeholders to disrupt these assets. Coal consumption is rapidly declining and production and prices with it. New electricity capacity is predominantly solar, wind and other renewables as industrial production is decoupling from traditional coal and gas fired energy production.

Transmission or network companies will be well placed to benefit from centralised battery storage and system management in concert with electricity system operators who stand to be winners if they are able to participate in the disruption. Network companies will have an important role to play in providing ongoing power quality, stability and reliability in partnership with an increasingly competitive off grid and micro-grid market.

Distributors on the other hand are likely to be losers as they are being faced with the “death spiral” (grid cost maintenance increases at the same time as the capital cost of solar decreases), and will be under pressure by electricity regulators to justify excess capacity no longer required in a modern network configuration. These electricity regulators will inevitably reduce the value of network infrastructure assets and allowable returns and therefore asset values.

Oil companies are the next sector to be impacted negatively by a structural shift to electric vehicles, which is expected to occur as early as 2025. It is forecast that an electric car with a 320km range will cost US$25,000 or less.

Impact of Energy Market Transformation

It is highly likely that financial markets are currently mispricing climate change risk.

Over the next decade mainstream financial markets will progressively rebalance their portfolios away from fossil fuel exposures and increasingly redirect capital to non-fossil fuel exposures and direct investment in renewables. Superannuation fund members are urging their trustees take action and require companies disclose their carbon impacts.

Australian investors are becoming interested in investment in the solar sector as it exhibits many of the characteristics prevalent in the early years of Infrastructure investment in Australia. These factors include long term contracted revenues, high operating margins and returns which are often CPI linked and not correlated to traditional equity or bond markets. It is however early days and infrastructure managers are applying their skills to aggregate solar infrastructure investment opportunities to capture the interest of mainstream institutional investors.

Investors are now actively seeking commercial returns from investments on offer in the Australian solar industry. In so doing, investors are able to powerfully apply their capital to achieve long term environmental and social benefits and accelerate Australia’s transition from fossil fuels toward a lower carbon society.

Mitchell King is the founder and Managing Director of Lighthouse Infrastructure. He is regarded as a leading global infrastructure fund manager who over the past two decades has been active in acquiring, managing and raising capital for infrastructure assets that leave a sustainable legacy for future generations. Development, financing and management of solar infrastructure assets has been a deliberate strategy of Lighthouse to participate in the development of the renewables industry that will fundamentally transform the energy industry in Australia to a lower carbon society over the next two decades.